When I come in contact with something that I think can help Ocean Hills Country Club buyers or other seniors, I just have to share. A purchase reverse mortgage is one of these things, and Owen Coyle is a great person to explain how it works.

Here is Owen Coyle’s bio in his own words:

“I’m Owen Coyle, a 79 year young “Seasoned Citizen” living in Escondido California.

As of April 1, 2015, I’m starting my 11th year as a Reverse Mortgage Specialist.

I have no desire to retire, so as long my health remains good, I’m planning on

setting up reverse mortgages for at least the next ten (10) years to age 90!!!

I absolutely have a passion for working with senior home owners, improving their

“Quality of Life” and giving them “Peace of Mind” by setting up reverse mortgages

for them.

A reverse mortgage is not for every senior, but when “it fits”, it can absolutely change their

life for the better. When I meet with the seniors, I always suggest that they include as

many of their children as possible in our meetings. I always want to have the entire family

“On The Same Page” and understand how the reverse mortgage will benefit their parents –

based on their particular situation.

Most reverse mortgage companies do business by using the telephone, email or U.S. Mail

and use a notary to take care of the reverse mortgage “Application” & “Closing Documents”.

I do business “The Old Fashion Way”. I go to the senior’s home and sit down with them

and their children at their kitchen and talk to them “Face to Face”. I make sure that I answer

all their questions and that the entire family understands how the program works.”

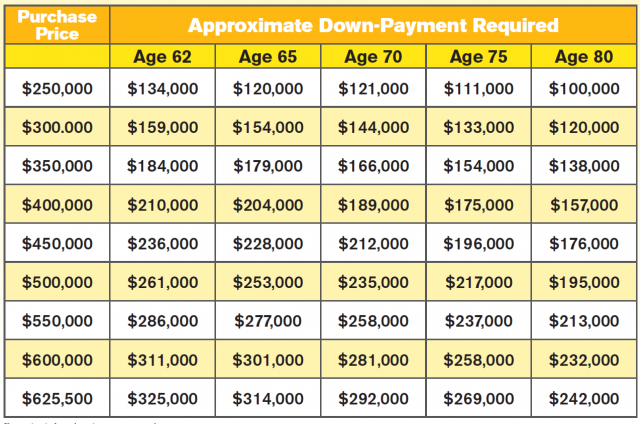

In 2015 there were many reverse mortgage revisions. Again, a reverse mortgage specialist like Owen Coyle in necessary to keep you up to date on the latest changes.

Gary Harmon, you Ocean Hills & Seniors Real Estate Specialist, would like to put you in touch with Owen. Just contact Gary Harmon to learn more.