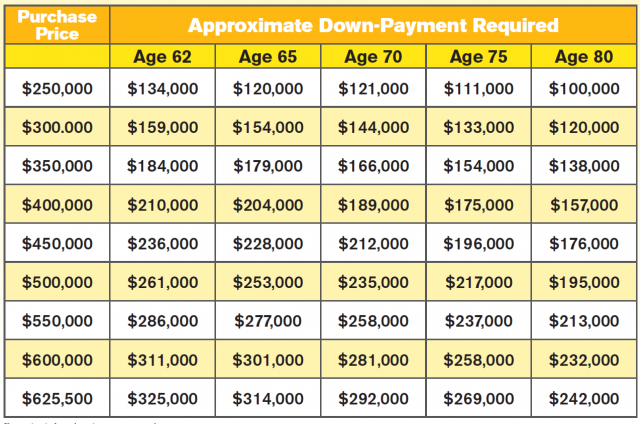

If you are considering buying an Ocean Hills home using a reverse mortgage, you may want to know how much down-payment is required. The answer isn’t always simple and depends on your age or the age of your spouse, whichever is younger. See table below.

HECM for purchase financing can make it easier and more affordable for Ocean Hills Country Club buyers 62 and older. They can buy an Ocean Hills home that better fits their lifestyle, without ever having to make a monthly mortgage payment. The chart above shows hypothetical examples of the down payment required with this type of mortgage option.

If you have ever considered a reverse mortgage, I have several different lenders that I could refer to you that are knowledgeable in the area.

Contact Gary Harmon, your Seniors Real Estate Specialist.